TORONTO, ONTARIO, May 06, 2010 (MARKETWIRE via COMTEX) -- Minera Andes Inc. (the "Corporation" or "Minera Andes") (CA:MAI 0.98, +0.03, +3.16%)(MNEA.F 0.91, -0.02, -2.37%) is pleased to announce 12 additional, and very encouraging, drill holes from our 100% owned Los Azules copper project in San Juan Province in Argentina. Highlights include a step-out hole 300 meters to the north of any previous drilling which contains 1.12% Cu over 62.5 meters (Hole 51). The other intercepts are from in-fill drilling and confirm the presence of an important high-grade secondary enrichment zone: 1.03% Cu over 101 meters (Hole 53A); 0.84% Cu over 52 meters and 0.83% Cu over 38 meters (Hole 57); 0.99% Cu over 84 meters (Hole 58); 0.90% Cu over 74 meters (Hole 59); and, 1.04% Cu over 168.2 meters (Hole 61A).

Exploration commenced in mid-December 2009, and four diamond drills have been operating on the project. A total of 22 diamond drill holes were completed this season for a total of 10,007 meters. Most of the drilling is infill drilling, although step-out holes drilled at the north end of the existing deposit extend the mineralization further north. The deposit remains open to the north, to the west, and at depth. In addition, we completed 615 meters of RC drilling in three holes that were drilled for geotechnical testing.

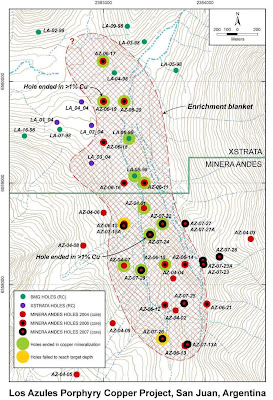

The objective of this field season's drilling program was to expand the known limits of mineralization, delineate the high-grade secondary enrichment zone and to increase the confidence level of the existing Los Azules resource. This resource contains 922 million tonnes grading 0.55 percent copper, equivalent to 11.2 billion pounds of copper, based on drilling completed through 2008. Also included in this resource is a high-grade core of 161 million tonnes grading 0.87 percent copper, which is equivalent to 3.1 billion pounds of copper. The known resource covers an area approximately 4 kilometers by 1 kilometer, and is open at depth and laterally. Please refer to figure 2 for a drill hole map.

Rob McEwen, Executive Chairman and CEO of Minera Andes commented:

"The continued success of the drilling is accomplishing our objective of increasing the confidence level of the resource at this world class deposit. The drilling is also continuing to define the extent of the high-grade secondary enrichment zone. Once all drill results have been received we will update and announce a new resource estimate. We are extremely pleased by the results of the drilling this season, and the project continues to look better and better as we gain additional information."

During this field season additional geological mapping was carried out and a state-of-the-art geophysical survey is nearly completed. The information gained from the geological mapping and geophysical survey will be utilized to target step-out drilling for the next field season's drilling. Engineering work and environmental base line studies to support a preliminary feasibility study are underway.

About Los Azules

Los Azules is a large copper porphyry system located in western San Juan Province in a belt of porphyry copper deposits that straddles the Chilean/Argentine border. This belt contains some of the world's largest copper deposits, including Codelco's El Teniente and Andina mines, Anglo American's Los Bronces mine, Antofagasta PLC's Los Pelambres mine and Xstrata's El Pachon project, among others.

About Minera Andes

Minera Andes is an exploration company exploring for gold, silver and copper in Argentina with three significant assets: A 49% interest in Minera Santa Cruz SA, which owns the San Jose Mine, a large primary silver producer that produced 4,998,000 million oz silver and 77,070 oz gold in 2009; 100% ownership of the Los Azules copper deposit; and, a portfolio of exploration properties in the highly prospective Deseado Massif region of Santa Cruz Province in southern Argentina. Minera Andes continues to be well funded and have no bank debt. The Corporation had $18.9 million USD in cash as at December 31, 2009.

This news release has been submitted by Jim Duff, Chief Operating Officer of the Corporation.

For further information, please contact: Jim Duff or visit our Web site:http://www.minandes.com/.

Scientific and Technical Information:

This news release has been reviewed and approved by Nivaldo Rojas, President of Rojas & Asociados Mining Consultants, a mining engineer and independent consultant to the Corporation, who is a Qualified Person as defined by National Instrument 43-101, and is responsible for oversight and review of the exploration program at the Los Azules Project, and Bruce Davis, PhD, FAusIMM, who is a Qualified Person as defined by National Instrument 43-101 and responsible for the quality control for the assaying of the Los Azules drill core. All samples were collected in accordance with industry standards. Splits from the drill core samples were submitted to the ACME sample preparation laboratory in Mendoza, Argentina, and then transferred to ACME's laboratory in Santiago, Chile for fire assay and ICP analysis. Accuracy of results is tested through the systematic inclusion of standards, blanks and check assays.

For further information in respect of the Los Azules project please refer to the technical report entitled "Canadian National Instrument 43-101 Technical Report in Support of the Preliminary Assessment on the Development of the Los Azules Project, San Juan Province, Argentina" dated March 19, 2009, the "Los Azules Report" prepared by Randolph P. Schneider, Robert Sim, Bruce Davis, William L. Rose, and Scott Elfen, each of whom is "independent" of the Corporation and a "qualified person" for the purposes of National Instrument 43-101 - "Standards of Disclosure for Mineral Projects . This report is available on SEDAR (http://www.sedar.com/). The results of the preliminary assessment referenced in this news release are preliminary in nature and include inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the project as described in the preliminary assessment will be realized. The basis for the preliminary assessment and the qualifications and assumptions made are set out in the Los Azules Report.

Cautionary Note to U.S. Investors:

All resource estimates reported by the Corporation were calculated in accordance with Canadian National Instrument 43-101 and the Canadian Institute of Mining and Metallurgy Classification system. These standards differ significantly from the requirements of the U.S. Securities and Exchange Commission. Mineral resources which are not mineral reserves do not have demonstrated economic viability.

Caution Concerning Forward-Looking Statements:

This press release contains certain forward-looking statements and information. The forward-looking statements and information express, as at the date of this press release, the Corporation's plans, estimates, forecasts, projections, expectations or beliefs as to future events and results and management's understanding of proposed legislative changes. Forward-looking statements involve a number of risks and uncertainties, and there can be no assurance that such statements will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements include, but are not limited to, factors associated with fluctuations in the market price of precious metals, mining industry risks, risks associated with foreign operations, risks related to on-going or pending litigation, property title, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral resources and reserves and other risks.

Readers should not place undue reliance on forward-looking statements or information. The Corporation undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See the Corporation's annual information form for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

Figure 1 - Summary of Drill Hole Results

Table.