Small print.

Some observations below are based on pure Science and some on solid Fiction, please be careful to draw any investment conclusions from some parts of the story. As a socially responsible citizens authors of this blog could benefit from your investment decisions regarding Ben Bernanke, Helicopters, Oil, Gold and Lithium.

CS. It is time for us to sharpen our pencil and put a few lines together about socio-economic events of this week which will have far reaching implications on our way of life. We will speculate on the real events behind the scene on a day of Cyber Meltdown: spectacular Dow Crash by the magnitude of 1000 point in fifteen minutes. We will develop a very strong argument in favour of Inflation and its cost based on PhD Thesis: At what point price of Oil becomes prohibitive to use Helicopters by Ben Bernanke in his open market operations. We will draw some lines on How Lithium, Gold and price of Oil are connected and what it means to be grounded. In the end we will leave you with the question: Where to invest - In Ben Bernanke, Ink Factory, Helicopters, Oil or Gold and Lithium?

Our memories from 2008 meltdown and the last deflation strike in March of last year are still too vivid for us to stay rational amid recent market panic of this week. Was it the fat finger, Cyber Meltdown or revenge of the Government Sachs, which was striped of its Olympus glamour is not so important - the most important message is the reaction of the Market itself and actions of the people in charge to follow.

We will even speculate that the real reason for Dow to crash 1000 points in fifteen minutes was subliminal classified message in the networks that helicopter commander Ben Bernanke have sent his helicopter squad to Europe. The squad was caught over Iceland in volcanic ash cloud and was grounded on deserted island and now all those precious billions of dollar bills are used in a camp fire to keep pilots warm. Messier Trichet from ECB has refused to send eurocopters stashed with cash and support the market operations on Thursday pointing to high oil prices and high price to be paid in the end of this kind of "open market" operations. He even went to length talking about austerity measures, economic reform, budget cuts and fiscal discipline. French connection with the Crash must be investigated further: first they took our wine lists, than mortgage based securities trading, what will be next? We will point only to the obvious: ECB head Jean-Claude Trichet the President of European Central Bank with his stubborn attitude to the Quantitative Easing. Next one will be Goldman Sachs Mr Fab himself - Fabrice Touree at the heart of the recent scandal. Have you noticed that this time Goldman Sachs were par excellence on transparency issues, it has avoided any double standards allegations and immediately released all emails of Mr Fab including his love letters and proper descriptions of all those variety of products sold to the sophisticated "widows and orphans" as they call our banks, stupid enough to buy that stuff. Buy the way they called these derivatives by a lot of misleading names for the clients in public documents, but in internal emails all use the same description and must be French word - S%&T. This twitter based letter combinations is raising the same emotions as the subject itself and we will allow ourselves to use it in this context, lacking the better alternative. This time Goldman Sachs was equally distant from its clients and employees - they were sacrificed immediately. In the end if The House does not give a S%&T about its clients, why attitude to employees should be different?

Here our part based on solid Fiction ends and we will move to pure Science.

As it is difficult to believe in the reasons behind the Thursday 1000 point Dow Crash we wrote above, we will make few observations based on real time market data. Market was trading down on Thursday from the opening with traders clued to the pictures from Greece violent Austerity Market Test, but they were sliding down in orderly fashion. At 14.00 sudden spike in Yen Dollar chart happen: Yen moved up and then all hell called Carry Trade has broken lose. Somebody big enough to get busted in a spectacular fashion was caught naked on Yen funding side. With rising Yen Rise of the Machines began: algorithmically driven buy orders start to protect from Yen run away, snow ball has driven Yen above USD by total 5% percent at one point. Please keep in mind that another Carry Trade funded in USD moved up against all other currencies as well: Euro and Pound were not spared, Hung Parliament in UK helped ignite the run on pound again. After Yen move within half an hour Dow started to crash: our take is that with running up Yen and following USD margin calls kicked in and selling began in most liquid stocks in Dow. Run away in Yen was stoped by Japanese Central Bank intervention to the magnitude of 2 trillion Yen. Dow Cyber Meltdown was protected by PPT, investors lost on filled stops much below limits and somebody big got busted for sure.

We will leave the situation on how technically stock like P&G could drop 50% in fifteen minutes to be investigated by the mass media, but will confirm here one more time: it was second Deflationary Test with sudden drop in liquidity this time driven by sovereign debt crisis. Call it Run On The Bank among Big Guys. Fifteen minutes made no mistake about the state of the market and economy in deflationary environment - we have seen the future and it is ugly. Deflation spiral means death of financial market by thousand cuts - financial system is insolvent and the only way to run it is to keep liquidity high enough that nobody is testing it to deliver. QE will provide flood of money, debt will be rolled over and by destroying the value of FIAT currencies Debt will be Inflated out in the end. This time it is different - it is not only our theory, but confirmed market action. This time the most important here is that Gold was at almost all time high at the moment of test, Gold was moving up against all currencies and this time in a sharp contrast to the events of 2008 it was sharply up and over 1200 on the day of Market Crash. This new round of QE (when Europe has not even started!) will be going already from this very high base in Gold value and rising Inflation in Commodity and Growth driven economies. We will not go into the debt issue today in details and will only point out that it is a notch under 13 Trillion and in dangerously close proximity to 100% of GDP of U.S.

After pictures from Greece we do not think that anybody will go there in U.S. Corp. Deflation will be prevented by any means, it is easy and price to pay is not so obvious. Newly printed US Dollars are "free", but price to drop them is not: you need Oil to keep you helicopters flying and here will be our first conundrum: At what point price of Oil becomes prohibitive to use Helicopters by Ben Bernanke in his open market operations?

Here is time to move to practical implications of the new Inflation round to fight Deflation Scare this time created by sovereign default. How Lithium, Gold and price of Oil are connected and what it means to be grounded? We will start with Gold and will give you few observations:

1. We are in a new Bull market territory with Gold moving up against all FIAT currencies.

2. Corporate default was exchanged on sovereign one, all bailouts were not more than transferring obligations from failed banks and other Corporations to the public finance. Bonuses were left with bankers, losses were privatised with public. Now we have on outskirts of Europe with less than 4% of EU GDP fireworks which suppose to end Euro legacy in wain. Do not rush to trash the Euro yet. Sovereign default is very different from corporate one. If the debt is issued in local currency it could be always printed more in order to repay it. U.S. Corp. is living in this space for years, UK is there and Europe will have to decide and move in support of Greece to prevent the run on the bank and collapse of the following PIIGS members.

3. Expect shakeouts, but the direction in Gold market is clear: further Up - driven by run from all FIAT currencies, rising interest rates, generational Bear market in Treasuries, negative real rates and expansion in monetary base (QE) with inevitable by definition Inflation. And we have to pray for it - we do not know how to survive in Deflation Spiral should anybody made a crucial mistake.

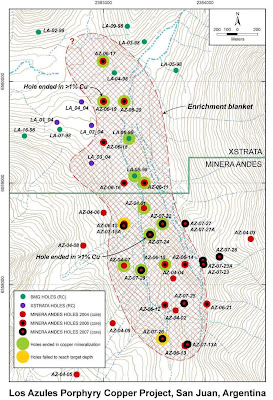

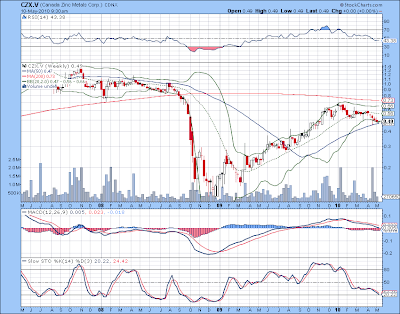

4. First Gold will make new all time high, second will be M&A play: Majors will shop for Juniors with resources in the ground. Here is the double game - Gold is moving up and Majors' production and Reserve Base is going down. If you like more leverage you are welcome to Silver market. Place to be is in stories will strong management, growing resources and stable political situations. markets will be volatile by all means and political tensions will be driving this Gold Bull as well.

We are running Gold Bull for nearly ten years now: Gold first, than Majors and follow up on Junior side. We were always wondering about Future of Energy and have collected some great memories on Uranium Run, Solar and Water plays. Gold Bull has years to run, but we are searching constantly for new Macro trends - it is very interesting to find out what will be the next Bull which will come out of these rubbles in case we are right and Inflation will be the answer to deflation war scenario. It is time for Lithium to come into picture.

Lithium is the leveraged play on Peak Oil and rising Oil price with coming Inflation. Sector is very small and market is even more smaller - everything is ready for the parabolic move in case of supporting fundamentals.

Recent Oil Spill shows the real price for Oil and leaves no doubt for us that there will be no more cheap oil: offshore drilling is costly now, it will be even more costly later. Relatively cheap Oil is in the hands of state owned companies in not so friendly to U.S. places. Oil squeeze will come from diminishing production rates and rising Inflation. The move will be even more explosive than in the Gold market - in the end only minority of people is effected by the gold price even now, Oil is the underlining of all Western Energy Diet. It is not sustainable. Emerging markets are taking more and more share of world wide production, oil producing countries are spending more at home. If you account all cost to produce, deliver and protect Oil supply to U.S. corp the price is already above 150 USD/barrel.

"Peak Oil and Lithium: Joint Operating Environment 2010

Please pay attention, this report is written by those who knows the Real Price of Oil. If you account all military needed to protect Oil supply lines and cost of wars to get more oil, price will be well above 150 USD/barrel already. Now we all have another problem: there is simply no more oil enough for all. Will future wars for oil be the only answer?"

Another "liberation" operation like Iraq, this time against Iran will break the camel's back with no return point. Competition for Oil is heating up and aggressive move by China into Electric Cars leaves no other options for US than to follow. In order to keep power China needs gradually improve standard of living, it will bring upside pressure on labor cost. Electrification will not only provide Energy Security to China, but will significantly reduce the cost of its transportation element and provide another opportunity to stay among low cost producers. Situation is completely different to U.S. - they have capital to invest in Electric Mobility CAPEX now and rip the rewards of lower cash cost on transportation side later. We will refer you to the Economics of Electric Cars.

Recent Ash Cloud events in Europe brought a very sobering sense of the feeling to be grounded. It is amazing how many things are taking for granted. This time it is Ash Cloud - what will happen with oil above 150?

Electric Cars is the only commercially viable technology today to sustain mobility world wide with rising Oil prices. Lithium is at the heart of Green Mobility revolution - it is an industry adopted standard for batteries and billions of dollars are invested into battery technology and upcoming by the end of this year Electric Cars on a mass market scale. This Bull market is still very young - only a year or so from the beginning after the crash of 2008.

We will provide you with few links to study the subject further:

1. Peak Oil.

2. Lithium ABCs.

3. Lithium the Next Big Thing for China Investments

4. The Future of the Lithium Market.

5. Lithium iPod moment.

.jpg)