Nothing is for certain, but our reversal in USD is well under way. With US Debt close to 13 Trillion all Euro situation is just an aberration in the History of US Dollar Collapse. US budget deficit is projected for years ahead to stay above 1 Trillion dollars with Gross Federal Debt well over 70% of GDP assuming it at 14 trillion, can you even imaging in U.S. German rules:

"Mr Schäuble also wants the other 15 members of the common currency to adopt a similar national law to the German debt guillotine, a law enshrined in the German constitution committing the government to a balanced budget, with a maximum structural budget deficit of just 0.35 per cent of GDP by 2016."

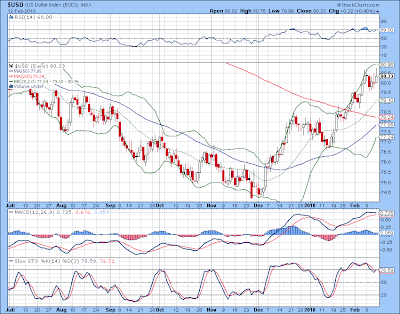

On a weekly chart US Dollar is very close to finish this week with a very strong Bearish reversal candle.

Do not burn your Euros yet, US Dollar was appreciating on Europe worries, but the weaker Euro is exactly what Europe needs in Competition for Export to Emerging markets and China first of all.

After pictures from Greece we do not think that anybody will go there in U.S. Corp. Deflation will be prevented by any means, it is easy and price to pay is not so obvious. Newly printed US Dollars are "free", but price to drop them is not: you need Oil to keep you helicopters flying and here will be our first conundrum: At what point price of Oil becomes prohibitive to use Helicopters by Ben Bernanke in his open market operations?

Here is time to move to practical implications of the new Inflation round to fight Deflation Scare this time created by sovereign default. How Lithium, Gold and price of Oil are connected and what it means to be grounded? We will start with Gold and will give you few observations:

Here is time to move to practical implications of the new Inflation round to fight Deflation Scare this time created by sovereign default. How Lithium, Gold and price of Oil are connected and what it means to be grounded? We will start with Gold and will give you few observations:

FT:

By Quentin Peel in Berlin

Published: May 20 2010 12:52 Last updated: May 21 2010 11:37

Germany’s lower house of parliament on Friday approved Berlin’s contribution to a €750bn stabilisation package for the eurozone.

After fraught talks with parties in the Bundestag on Thursday, it became clear that Angela Merkel, chancellor, would win a majority in favour of German credit guarantees of up to €150bn ($187bn, £130bn) from her centre-right coalition but fail to win cross-party support from the opposition Social Democrats and Greens.

The Bundestag passed the bill with 319 votes in favour, 73 against and 195 abstentions. The Bundesrat upper house is expected to pass the bill later on Friday.

Ms Merkel’s promises of tougher rules for the eurozone and action to curb speculation in the financial markets have been part of the price to win parliamentary support for the loan guarantees. A move to ban naked short-selling of eurozone debt was also seen in Berlin as a clear political gesture to win the parliamentary majority

On Thursday Ms Merkel stepped up pressure for a global agreement on tighter financial regulation, a banking tax or levy and a financial transaction tax, while spelling out the rules it wants members of the eurozone to adopt to curb their public debts and deficit spending.

George Osborne, UK chancellor, was separately expected to tell EU finance ministers in Brussels on Friday that Britain would resist attempts to improve economic governance that require a change to the European Union treaty.

The new UK government is committed to a referendum on any treaty that transfers new powers to Brussels. Mr Osborne has said he will oppose suggestions that he should show his Budget to the European Commission before presenting it to parliament.

Thomas De Maizière, Germany’s interior minister, said Berlin would increasingly seek to defend its own interest in the EU while shedding its role as passive paymaster. “Germany is going to act just as other European countries do in Brussels and this will not make it automatically anti-European,” he said.

Wolfgang Schäuble, finance minister, published a nine-point programme of proposals for more rigorous policing of the budgetary policies of eurozone members, including a proposal to draw up a procedure for “orderly state insolvencies” for countries that cannot service their debts.

Other points in his plan, to be presented on Friday at the first meeting of a task force in Brussels charged with rewriting the rules of the common currency area, include stripping countries of their votes if they persistently break stability and growth pact limits on deficit spending, and cutting them off from regional investment funds.

Mr Schäuble also wants the other 15 members of the common currency to adopt a similar national law to the German debt guillotine, a law enshrined in the German constitution committing the government to a balanced budget, with a maximum structural budget deficit of just 0.35 per cent of GDP by 2016.

Ms Merkel and Mr Schäuble are adamant that more action must be taken at the level of both the EU and the Group of 20 economies to regulate financial markets, in addition to adopting much more rigorous budget controls within the EU.

Ms Merkel called on financial institutions to give “honest advice” about how their activities should be regulated, warning they would face political measures to regulate the markets whatever happened.

Mr Schäuble appeared more sceptical. Challenged to defend Germany’s ban on naked short selling in light of the hostile reaction in the markets, the minister said: “If you want to drain a swamp, you don’t ask the frogs for an objective assessment.”

Additional reporting by Joshua Chaffin in Berlin and George Parker in London

Published: May 20 2010 12:52 Last updated: May 21 2010 11:37

Germany’s lower house of parliament on Friday approved Berlin’s contribution to a €750bn stabilisation package for the eurozone.

After fraught talks with parties in the Bundestag on Thursday, it became clear that Angela Merkel, chancellor, would win a majority in favour of German credit guarantees of up to €150bn ($187bn, £130bn) from her centre-right coalition but fail to win cross-party support from the opposition Social Democrats and Greens.

The Bundestag passed the bill with 319 votes in favour, 73 against and 195 abstentions. The Bundesrat upper house is expected to pass the bill later on Friday.

Ms Merkel’s promises of tougher rules for the eurozone and action to curb speculation in the financial markets have been part of the price to win parliamentary support for the loan guarantees. A move to ban naked short-selling of eurozone debt was also seen in Berlin as a clear political gesture to win the parliamentary majority

On Thursday Ms Merkel stepped up pressure for a global agreement on tighter financial regulation, a banking tax or levy and a financial transaction tax, while spelling out the rules it wants members of the eurozone to adopt to curb their public debts and deficit spending.

George Osborne, UK chancellor, was separately expected to tell EU finance ministers in Brussels on Friday that Britain would resist attempts to improve economic governance that require a change to the European Union treaty.

The new UK government is committed to a referendum on any treaty that transfers new powers to Brussels. Mr Osborne has said he will oppose suggestions that he should show his Budget to the European Commission before presenting it to parliament.

Thomas De Maizière, Germany’s interior minister, said Berlin would increasingly seek to defend its own interest in the EU while shedding its role as passive paymaster. “Germany is going to act just as other European countries do in Brussels and this will not make it automatically anti-European,” he said.

Wolfgang Schäuble, finance minister, published a nine-point programme of proposals for more rigorous policing of the budgetary policies of eurozone members, including a proposal to draw up a procedure for “orderly state insolvencies” for countries that cannot service their debts.

Other points in his plan, to be presented on Friday at the first meeting of a task force in Brussels charged with rewriting the rules of the common currency area, include stripping countries of their votes if they persistently break stability and growth pact limits on deficit spending, and cutting them off from regional investment funds.

Mr Schäuble also wants the other 15 members of the common currency to adopt a similar national law to the German debt guillotine, a law enshrined in the German constitution committing the government to a balanced budget, with a maximum structural budget deficit of just 0.35 per cent of GDP by 2016.

Ms Merkel and Mr Schäuble are adamant that more action must be taken at the level of both the EU and the Group of 20 economies to regulate financial markets, in addition to adopting much more rigorous budget controls within the EU.

Ms Merkel called on financial institutions to give “honest advice” about how their activities should be regulated, warning they would face political measures to regulate the markets whatever happened.

Mr Schäuble appeared more sceptical. Challenged to defend Germany’s ban on naked short selling in light of the hostile reaction in the markets, the minister said: “If you want to drain a swamp, you don’t ask the frogs for an objective assessment.”

Additional reporting by Joshua Chaffin in Berlin and George Parker in London