VANCOUVER, BRITISH COLUMBIA--(Marketwire - May 17, 2010) - TNR Gold Corp. (TSX VENTURE:TNR - News) and its wholly-owned subsidiary, Solitario Argentina S.A. (collectively, "TNR"), have filed an Amended Statement of Defence and Counterclaim in the Supreme Court of British Columbia responding in detail to the Statement of Claim filed by Minera Andes Inc. and certain related entities (together, "Minera Andes").

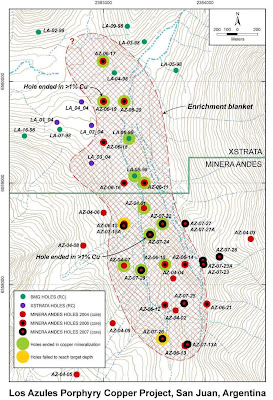

As disclosed in our April 23, 2010 press release, TNR notified Minera Andes that it was exercising its back-in right for 25% of certain of the properties constituting the Los Azules project in Argentina (the "Los Azules Project"). Minera Andes is contesting TNR's ability to exercise its back-in right.

The Amended Statement of Defence sets out, among other things, TNR's position as to why the back in clause in the May 2004 Exploration and Option Agreement should be rectified to remove reference to a feasibility study being completed within 36 months, and why the condition linking the timing of the back-in right to the production of a feasibility study was for the sole benefit of TNR and, therefore, could be waived by TNR. TNR has brought a Counterclaim which seeks a positive declaration from the court that TNR's April 23, 2010 back-in notice is valid and enforceable.

We encourage interested parties to review the Amended Statement of Defence and Counterclaim in their entirety on our website for a better understating of our position. The link for this information is as follows:

http://media3.marketwire.com/r/Counterclaim

ABOUT TNR GOLD

TNR and International Lithium Corp ("ILC") are diversified metals exploration companies focused on exploring existing properties and identifying new prospective projects globally. TNR has a portfolio of 18 active projects, of which 9 will be included in the proposed spin-off of International Lithium Corp. For further details of the spin-off please refer to TNR's April 12, 2010 press release or visit http://www.internationallithium.com/.

The recent acquisition of lithium, other rare metals and rare-earth elements projects in Argentina, Canada, USA and Ireland confirms the companies' commitments to generating projects, diversifying its markets, and building shareholder value.

On behalf of the board,

Gary Schellenberg, President

Cautionary Language and Forward-Looking Statements

This press release includes certain statements that may be deemed "forward-looking statements". All statements in this discussion, other than statements of historical facts, that address future exploration drilling, exploration activities and events or developments that TNR expects, including the outcome of pending and current litigation, are forward looking statements. Although the Company believes the expectations expressed in such forward looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include metal prices, exploration successes, continued availability of capital and financing, and general economic, market or business conditions. In particular, there are no assurances that TNR will be successful in the current litigation with respect to the Los Azules Project and its back-in right. Accordingly, readers should not place undue reliance on forward-looking statements. This press release and the information contained herein does not constitute an offer of securities for sale in the United States and securities may not be offered or sold in the United States absent registration or exemption from registration.

In addition, it should be noted that the Statement of Defence and Counterclaim are not intended to be, and should not be interpreted as, sources of factual, business or operational information about TNR or any of its affiliates. The Statement of Defence and Counterclaim contain assertions that have been prepared solely for use in connection with the legal dispute with Minera Andres, have not been proven and should, therefore, not be relied upon.

CUSIP: #87260X 109

SEC 12g3-2(b): Exemption #82-4434

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release."