TNR Gold is pushing its case with Los Azules further and the key for us in this NR are the new people involved and: "The Company fully intends on exercising its back-in right to the properties at the appropriate time." Looks like company is taking a serious approach to finance its back in right execution. Time is to check all story.

Chinese are circling the globe in their hunt for resources, Rob McEwen drills Los Azules like a Swiss cheese - we like this combination. Resources of this impressive copper and gold deposit in Argentina will be bigger, question is how much bigger. Small junior TNR Gold squeezed in between all these players on the chess board and reminds about its rights to the part of the property, famous litigators, Xstrata, Lundin family and Chinese Togling - are all in the picture. The outcome is highly leveraged to Copper prices, success in litigation and totally uncertain at the moment, hopefully next move will bring more clarity to all involved parties. Will Rob McEwen be ready to talk to the junior or he will be sided with Xstrata? In any case aggressive exploration program brings project into the spotlight and Rob McEwen is ready to draw a number in prefeasibility as early as next year now.

We are holding a position in the company and, please, do not consider anything as an investment advise on this Blog, as usual."

What is at stake:

"Now Los Azules is a Top Project for Rob McEwen according to Minera Andes presentation:

Los Azules in Minera Andes presentation

More on the Canaccord valuation of Los Azules:

Gold and Copper in Argentina: Rob McEwen, Los Azules and TNR Gold.

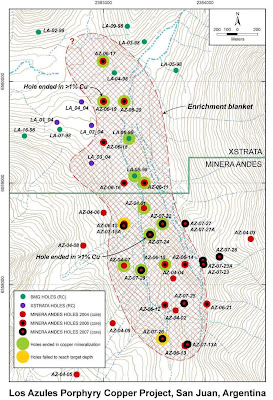

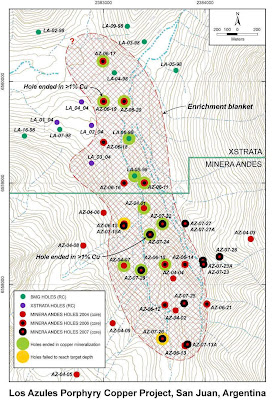

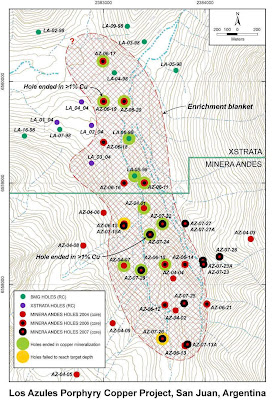

"Rob McEwen CEO of Minera Andes was marketing Los Azules in San Francisco with the following:"Los Azules Copper DiscoveryInferred resource containing over 11 billion pounds of copper.

Larger than 83% of the world's copper deposit.

Open at depth and to the north for over 2 miles.

High Grade Core: Approximately 105 million tons of 1% copper near-surface!

Los Azules Preliminary Assessment

NPV (USD 3.0/lb, 8% discount rate) - $4 Billion

IRR - 25%Initial Capital Expenditure - 2.7 Billion

Mine Life - 23.6 years."

Who is involved

Who is involved:

"

TNR has George K. Macintosh, Q.C.- one of the best lawyers in Canada working on the case. It will be interesting to see how law suit with Xstrata will go on and weather Rob McEwen will be open to a deal with a junior in order to clear the title of Los Azules and be able to market Los Azules project on the market. Canada Zinc Metals CZX.v stays as a wild card in the game with Chinese Tongling owning 13%. With recent activity in share price of CZX.v, we will not be surprised that Canaccord is right and company will be taken out at one stage. In this case Chinese Tongling as a shareholders in TNR Gold will add spice to the game around this huge Copper and gold mine in Argentina."

Who is coming into the picture now from TNR Gold side:

"British Swiss Investment Corp.

MARK KUCHER, has served as a Director of the Company and the Company's Principal Financial Officer since April 2004. From April 2004 to September 2004, he was also the Company's President, Chief Executive Officer, Secretary and Treasurer. Since January 1992, he has also served as an officer, director and shareholder of British Swiss Investment Corp., a private Swiss corporation acting on behalf of Swiss pension funds in the disposition of various resource investments in Canada, predominantly in oil and gas and gold mining.

Mr. Kucher has commercial, business development and corporate finance experience with an emphasis in the mining industry.

Mr. Kucher has also had various positions with investment banks and brokerage firms.

Mr. Kucher holds an MBA from the University of Western Ontario and a Bachelor of Commerce Degree from The University of Manitoba."

Mark Kucher has build one of the first Royalty Companies -

Battle Mountain Gold Exploration Corp. and sold it to Royal Gold back in 2007. We guess he knows a thing or two about royalties, NSR and financing of the back in rights, but further action will be be the ultimate test to TNR Gold's position in this case.

"Royal Gold and Battle Mountain Gold Exploration Sign Definitive Merger Agreement

Royal Gold, Inc.DENVER, April 18 / -- ROYAL GOLD, INC. (NASDAQ:RGLD) ("Royal Gold") and Battle Mountain Gold Exploration Corp. (BULLETIN BOARD: BMGX) ("Battle Mountain") announced today that they have signed a definitive merger agreement under which Royal Gold will acquire 100% of the fully diluted shares of Battle Mountain in an all-stock merger transaction. The merger agreement was unanimously approved by both companies' boards of directors. This transaction was initially discussed in Royal Gold's March 5, 2007, press release...

Royal Gold has obtained agreements from Mark Kucher, Chairman of Battle Mountain, and IAMGOLD Corporation providing that each will vote its respective shares in favor of the merger transaction. These agreements represent approximately 39.9% of the outstanding shares of Battle Mountain.

The closing of this transaction is subject to Battle Mountain shareholder approval, satisfactory completion of due diligence, receipt of any regulatory approvals, and satisfaction of customary conditions.

Battle Mountain is a precious metals royalty company with a portfolio consisting of royalties on 12 properties located mainly in the Americas. Their principal assets include a 3.25% net smelter return ("NSR") royalty on gold production and a 2.0% NSR royalty on silver production from the Dolores project in Mexico, which is under development by Minefinders Corporation Ltd. Battle Mountain has disclosed that their royalty properties contain approximately 4.8 million ounces of gold reserves and 136 million ounces of silver reserves.

Royal Gold is a precious metals royalty company engaging in the acquisition and management of precious metal royalty interests. Royal Gold is publicly-traded on the NASDAQ Global Select Market under the symbol "RGLD," and on the Toronto Stock Exchange under the symbol "RGL." The Company's web page is located at

http://www.royalgold.com/."

TNR Gold Engages Financial Advisor for Its Los Azules Copper Project

Press Release Source: TNR Gold Corp. On Monday March 1, 2010, 9:30 am EST

VANCOUVER, BRITISH COLUMBIA--(Marketwire - March 1, 2010) -

TNR Gold Corp. ("TNR" or the "Company") (TSX VENTURE:

TNR -

News) is pleased to announce that it has engaged British Swiss Investment Corp. ("BSIC") to undertake a strategic review of TNR's alternatives for its Los Azules project (the "Project") located in the San Juan Province of western central Argentina. The possible alternatives to be reviewed may include a sale of all or a portion of the Project, a joint venture or similar arrangement with respect to the Project, or an equity, debt or convertible financing, or any combination of these, to fund the development of the Project. At this point there are no assurances that any transaction will result from this strategic review.

The Los Azules project is an advanced exploration project currently reporting a National Instrument 43-101 compliant Inferred Resource. TNR has previously announced that Minera Andes Inc. ("MAI") has commenced a diamond drill program of approximately 8,800 metres at the Los Azules project. Please refer to MAI's news release dated January 12, 2010 for further details on the exploration program.

TNR retains a 25 per-cent back-in right to certain of the properties, the terms of which are currently the subject of a legal dispute with Xstrata, which assigned its interest to MAI. A court date is set for the fall of 2010. The Company fully intends on exercising its back-in right to the properties at the appropriate time. In the legal dispute with Xstrata, TNR is also seeking confirmation of its ownership of the Escorpio IV property, which is located adjacent to the Project, and a declaration that the Escorpio IV property is excluded from the Exploration and Option Agreement.

BSIC is an investment firm that provides late stage venture capital, strategic consulting and transaction advisory services to companies in the resource business. BSIC has been a lead investor in and an advisor to a number of successful junior resource companies, including Aurex Resources Ltd. (TSX:

AXR -

News), Battle Mountain Gold Exploration Inc. (OTC:

BMGX -

News), Invader Exploration Inc. (TSX:

INV -

News), and Princeton Mining Inc. (TSX:

PMC -

News). BSIC was incorporated in British Columbia in 1990. The principals of BSIC are Mark Kucher (604-696-9720) and Steven Nevard (604-696-9721).

ABOUT TNR GOLD / INTERNATIONAL LITHIUM CORP.

TNR and ILC are diversified metals exploration companies focused on exploring existing properties and identifying new prospective projects globally. TNR has a portfolio of 18 active projects, of which 9 will be included in the proposed spin-off of International Lithium Corp. For further details of the spin-off please refer to TNR's April 27, 2009 news release or visit

http://www.internationallithium.com/.

The recent acquisition of lithium, other rare metals and rare-earth elements projects in Argentina, Canada, USA and Ireland confirms the companies' commitments to generating projects, diversifying its markets, and building shareholder value.

On behalf of the board,

Gary Schellenberg, President

Cautionary Language and Forward-Looking Statements

This press release includes certain statements that may be deemed "forward-looking statements". All statements in this discussion, other than statements of historical facts, that address future exploration drilling, exploration activities and events or developments that the Company expects, are forward looking statements. Although the Company believes the expectations expressed in such forward looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include metal prices, exploration successes, continued availability of capital and financing, and general economic, market or business conditions. Accordingly, readers should not place undue reliance on forward-looking statements.

In particular, there are no assurances that any transaction will result from the strategic review, or that if any transaction arises, that it will be completed. Nor are there any assurances that the Company will be successful in the current litigation with respect to the Project. This news release and the information contained herein does not constitute an offer of securities for sale in the United States and securities may not be offered or sold in the United States absent registration or exemption from registration.

CUSIP: #87260X 109

SEC 12g3-2(b): Exemption #82-4434

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release."

.jpg)