Tongling exercises its warrants at 20% premium to the market today (0.50CAD) - it is a very positive sign of commitment. Now Chinese company holds 17.5% in Canada Zinc Metals CZX.v, when will they bid for the whole company? Another important shareholder is Lundin Mining LUN.to With new Bailout in Europe direction is to Inflation and Commodities are the place to be. Another company we are following here is engaged in this Chinese M&A in Canada story: TNR Gold Corp. with International Lithium Corp. where CZX has a stake. Will shareholders in TNR Gold wake up one morning with new Chinese connection one day?

Canada Zinc Metals CZX.v now has very prominent shareholders - players in Zinc market like Chinese Tongling and Lunding Mining LUN.to. Togling has paid for 13% in the company price of 0.425CAD above even today's level of 0.4CAD.

We have called the company and can share with you some information for your further consideration. Please do not take anything as an investment advise and contact the company to verify all information.

"CZX’s Cardiac Creek deposit (Akie property) represents one of the top 10 largest undeveloped zinc deposits on the planet. The deposit is very good grade with a very high grade section within it that could be mined first (quicker payback of capital). CZX also has a very large prospective land package – this represents a district scale opportunity in mining friendly BC, Canada. Infrastructure in the area is relatively advanced (full road access, railway, power facility, deep sea port). Neighboring property / deposits owned by big players Teck Resources and Korea Zinc. We are going to China to visit Tongling and other Chinese companies next week for further discussions on our project development"

We have called the company and can share with you some information for your further consideration. Please do not take anything as an investment advise and contact the company to verify all information.

"CZX’s Cardiac Creek deposit (Akie property) represents one of the top 10 largest undeveloped zinc deposits on the planet. The deposit is very good grade with a very high grade section within it that could be mined first (quicker payback of capital). CZX also has a very large prospective land package – this represents a district scale opportunity in mining friendly BC, Canada. Infrastructure in the area is relatively advanced (full road access, railway, power facility, deep sea port). Neighboring property / deposits owned by big players Teck Resources and Korea Zinc. We are going to China to visit Tongling and other Chinese companies next week for further discussions on our project development"

We will see in the nearest future, whether this market represent to us again opportunity to step in the Commodity Super Cycle and the more boring and forgotten story seems to be - the best value you can get with all proper investigation of management and property strengths."

With rising Zinc prices value in the ground is rising as well, another value driver is exploration: company has set anagressive exploration program for this summer season now.

"2010 AKIE PROPERTY EXPLORATION PROGRAM

Canada Zinc Metals Corp.'s planning is progressing well for the 2010 exploration program on its flagship, 100-per-cent-owned Akie zinc-lead property, located in northeastern British Columbia, approximately 260 kilometres north-northwest of the community of Mackenzie.

Canada Zinc Metals Corp.'s planning is progressing well for the 2010 exploration program on its flagship, 100-per-cent-owned Akie zinc-lead property, located in northeastern British Columbia, approximately 260 kilometres north-northwest of the community of Mackenzie.

The objectives of this program on the Akie property are twofold:

To test the permissive Gunsteel formation -- Road River Group stratigraphy present along strike to the northwest of the Cardiac Creek deposit for the continuation of this mineralization;

To further explore the highly prospective North lead anomaly, located approximately 2.2 kilometres to the northwest of the Cardiac Creek deposit, which is underlain by similar geology. Previous drilling has encountered massive sulphides containing sphalerite and galena (0.8 metre grading 11.60 per cent Zn and 9.05 per cent Pb), sulphide replacement (pyrite, sphalerite, galena) of an underlying footwall debris flow and quartz-carbonate alteration of footwall rocks, all suggestive of proximity to a vent zone."

To test the permissive Gunsteel formation -- Road River Group stratigraphy present along strike to the northwest of the Cardiac Creek deposit for the continuation of this mineralization;

To further explore the highly prospective North lead anomaly, located approximately 2.2 kilometres to the northwest of the Cardiac Creek deposit, which is underlain by similar geology. Previous drilling has encountered massive sulphides containing sphalerite and galena (0.8 metre grading 11.60 per cent Zn and 9.05 per cent Pb), sulphide replacement (pyrite, sphalerite, galena) of an underlying footwall debris flow and quartz-carbonate alteration of footwall rocks, all suggestive of proximity to a vent zone."

"This stock represents an opportunity to invest in Chinese Infrastructure via Zinc resource development in Canada. Who will be the final suitor of Akie Chinese Tongling or Lundin Mining? "Strategic investment" in TNR Gold with its upcoming focused Lithium play - International Lithium Corp. adds some spice to the picture with solid resource base in the stable mining environment.

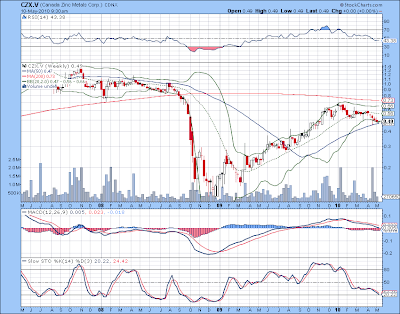

"Canada Zinc Metals CZX.v will be another example of Chinese expansion into Canada. Canadian Juniors will be the most exited public with all recent developments, interesting to note, that sector is building reversal which is more aggressive than USD and Gold pace of changing direction - we have a bullish candle and Free White Soldiers, bullish reversal will be confirmed with crossing MA50."

Posted on 05/10/10 at 7:36am by Chip Brian

Canada Zinc Metals Corp. (CZX - TSX Venture), is pleased to announce that Tongling Nonferrous Metals Group Holdings Co. Ltd. ("Tongling") has exercised 5.75 million share purchase warrants to acquire 5.75 million common shares at a price of $0.60 per share, for proceeds to the Company of $3,450,000.

"The Cardiac Creek deposit is one of the most significant discoveries in Canada in the past several years," commented Mr. Peeyush Varshney, CEO of Canada Zinc Metals. "We are pleased to see Tongling increase its stake in the Company."

With the exercise of the warrants, Tongling now holds a 17.65% equity position in the Company.

The proceeds of the private placement will be used to fund further exploration and advancement of the Company's Akie property and for working capital purposes.

Tongling Nonferrous Metals Group Holdings Co. Ltd., based in Tongling, Anhui, is a state-owned holding company, and one of China's largest copper smelting companies. Tongling's principal activities are exploration, mining, ore processing, smelting & refining and products processing of copper, lead, zinc, gold, silver and other non-ferrous and rare metals.

About Canada Zinc Metals Corp.

Canada Zinc Metals is a mineral exploration company focused on unlocking the potential of a future long life mining district in British Columbia, Canada. The Company is the dominant land holder in a world class mineral belt called the Kechika Trough which hosts in excess of 80 million tonnes of base metal resources. Canada Zinc Metals owns a total of 78,526 hectares in 233 claims which extend northwestward from the Akie property for a distance of 125 km.

About the Akie Property

The Akie zinc-lead property is situated within the southern-most part (Kechika Trough) of the regionally extensive Paleozoic Selwyn Basin, one of the most prolific sedimentary basins in the world for the occurrence of SEDEX zinc-lead-silver and stratiform barite deposits.

Drilling on the Akie property by Inmet Mining Corporation during the period 1994 to 1996 and by Canada Zinc Metals since 2005 has identified a significant body of baritic-zinc-lead SEDEX mineralization (Cardiac Creek deposit). The deposit is hosted by variably siliceous, fine grained clastic rocks of the Middle to Late Devonian 'Gunsteel' formation. The Company has filed a NI 43-101 report supporting the estimated inferred resource of 23.6 million tonnes grading 7.6% Zn, 1.5% Pb and 13.0 g/t Ag (at a 5% Zn cut off grade). The complete NI 43-101 technical report, titled "Geology, Diamond Drilling and Preliminary Resource Estimation, Akie Zinc-Lead-Silver Property, Northeast British Columbia, Canada" and dated May 30, 2008, can be viewed on SEDAR.

Two similar deposits, Cirque and South Cirque, located some 20 km northwest of Akie and owned under a joint venture by Teck Cominco and Korea Zinc, are also hosted by Gunsteel rocks and have a combined geologic inventory in excess of 50 million tonnes.

The TSX Venture Exchange has neither approved nor disapproved the contents of this press release.

ON BEHALF OF THE BOARD OF DIRECTORS

CANADA ZINC METALS CORP.

"PEEYUSH VARSHNEY"

PEEYUSH VARSHNEY, LL.B

CEO & CHAIRMAN

Contact: Investor Relations

Phone (604) 684-2181

info@canadazincmetals.com"

Canada Zinc Metals Corp. (CZX - TSX Venture), is pleased to announce that Tongling Nonferrous Metals Group Holdings Co. Ltd. ("Tongling") has exercised 5.75 million share purchase warrants to acquire 5.75 million common shares at a price of $0.60 per share, for proceeds to the Company of $3,450,000.

"The Cardiac Creek deposit is one of the most significant discoveries in Canada in the past several years," commented Mr. Peeyush Varshney, CEO of Canada Zinc Metals. "We are pleased to see Tongling increase its stake in the Company."

With the exercise of the warrants, Tongling now holds a 17.65% equity position in the Company.

The proceeds of the private placement will be used to fund further exploration and advancement of the Company's Akie property and for working capital purposes.

Tongling Nonferrous Metals Group Holdings Co. Ltd., based in Tongling, Anhui, is a state-owned holding company, and one of China's largest copper smelting companies. Tongling's principal activities are exploration, mining, ore processing, smelting & refining and products processing of copper, lead, zinc, gold, silver and other non-ferrous and rare metals.

About Canada Zinc Metals Corp.

Canada Zinc Metals is a mineral exploration company focused on unlocking the potential of a future long life mining district in British Columbia, Canada. The Company is the dominant land holder in a world class mineral belt called the Kechika Trough which hosts in excess of 80 million tonnes of base metal resources. Canada Zinc Metals owns a total of 78,526 hectares in 233 claims which extend northwestward from the Akie property for a distance of 125 km.

About the Akie Property

The Akie zinc-lead property is situated within the southern-most part (Kechika Trough) of the regionally extensive Paleozoic Selwyn Basin, one of the most prolific sedimentary basins in the world for the occurrence of SEDEX zinc-lead-silver and stratiform barite deposits.

Drilling on the Akie property by Inmet Mining Corporation during the period 1994 to 1996 and by Canada Zinc Metals since 2005 has identified a significant body of baritic-zinc-lead SEDEX mineralization (Cardiac Creek deposit). The deposit is hosted by variably siliceous, fine grained clastic rocks of the Middle to Late Devonian 'Gunsteel' formation. The Company has filed a NI 43-101 report supporting the estimated inferred resource of 23.6 million tonnes grading 7.6% Zn, 1.5% Pb and 13.0 g/t Ag (at a 5% Zn cut off grade). The complete NI 43-101 technical report, titled "Geology, Diamond Drilling and Preliminary Resource Estimation, Akie Zinc-Lead-Silver Property, Northeast British Columbia, Canada" and dated May 30, 2008, can be viewed on SEDAR.

Two similar deposits, Cirque and South Cirque, located some 20 km northwest of Akie and owned under a joint venture by Teck Cominco and Korea Zinc, are also hosted by Gunsteel rocks and have a combined geologic inventory in excess of 50 million tonnes.

The TSX Venture Exchange has neither approved nor disapproved the contents of this press release.

ON BEHALF OF THE BOARD OF DIRECTORS

CANADA ZINC METALS CORP.

"PEEYUSH VARSHNEY"

PEEYUSH VARSHNEY, LL.B

CEO & CHAIRMAN

Contact: Investor Relations

Phone (604) 684-2181

info@canadazincmetals.com"